|

|

def | set_size (self, size) |

| |

| def | initialize (self) |

| |

| def | greeks (self, day, vol=None) |

| |

|

def | get_orders (self, day, size, tag, entry=True) |

| |

| def | position_diagram (self, current_date, evaluation_date, valuation_prices) |

| |

|

def | __new__ (cls, name, bases, namespace, **kwds) |

| |

|

def | __call__ (cls, *args, **kwargs) |

| |

|

|

list | component_weights = [] |

| |

◆ greeks()

| def strategy.OptionStrategy.greeks |

( |

|

self, |

|

|

|

day, |

|

|

|

vol = None |

|

) |

| |

Calculates the greeks for the strategy.

◆ initialize()

| def strategy.OptionStrategy.initialize |

( |

|

self | ) |

|

◆ position_diagram()

| def strategy.OptionStrategy.position_diagram |

( |

|

self, |

|

|

|

current_date, |

|

|

|

evaluation_date, |

|

|

|

valuation_prices |

|

) |

| |

Computes position diagram for option.

Will return value of option up to 4 standard deviations away from strike.

If day_offset is None we return value at expiry, otherwise we price the option.

The documentation for this class was generated from the following file:

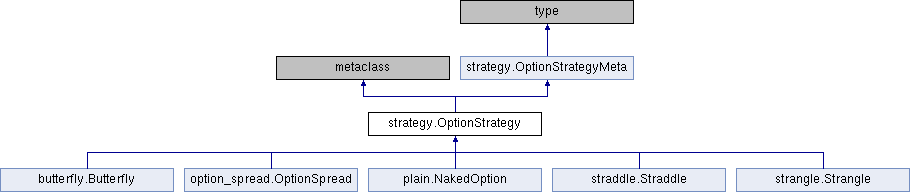

Public Member Functions inherited from strategy.OptionStrategyMeta

Public Member Functions inherited from strategy.OptionStrategyMeta 1.8.15

1.8.15